Two days after Federal Reserve Chair Jerome Powell announced the central bank’s decision not to reduce interest rates, the Bureau of Labor Statistics reported scathingly bad news about the U.S. economy.

Employers added much fewer jobs than expected in July, revised numbers showed that employment and hiring were weak in May and June, and the unemployment rate ticked up again in July, reaching 4.2%.

Powell and the Fed have been doing their best to stunt economic growth — and they are succeeding.

Although Powell refuses to admit it, the Fed’s tight money policy is crushing economic growth.

In an impressive “Dewey Defeats Truman” moment, Powell said on Wednesday that the Fed was not ready to lower interest rates, citing low unemployment and inflation slightly above the Fed’s stated goal of 2%. Despite the Fed having lowered its target interest rate three times last fall to its current level — even though inflation remained “somewhat elevated” at the time, as the Fed put it — the Fed seems to have changed its tune under the Trump administration.

Friday’s numbers destroyed Powell’s explanation. The 73,000 new jobs in July were far below the 110,000 that economists had expected. In addition, the Bureau of Labor Statistics cut the reported job-creation totals for May and June from a healthy 291,000 to a dismal 33,000.

The economy has clearly been wobbly since January 2021 brought the tax-spend-borrow strategy that created the Biden-era fiscal disaster. The Fed caused the 2020s inflation by monetizing the Biden administration’s massive, irresponsible increase in the federal deficit and debt; boosting the money supply by 12.3% from January 2021 to April 2022; and holding the Fed funds rate around 0.08% until March 18, 2022, when the Fed raised it to a meager 0.33%.

The Fed’s target interest rate is now 4.33%, much higher than it has been at any other time in the 2000s except for the run-up to the Great Recession of 2008.

Punting responsibility

The central bank watched inflation soar during the Biden administration and wants to ensure that it does not recur. The Fed has used high interest rates and asset sales to tighten the money supply for three years now. Recent money supply growth has been lower than normal.

The federal budget has stabilized now, however, surprisingly running a slight surplus in June, which is relieving the main source of inflationary pressure. The surplus will undoubtedly prove temporary, but the lower-deficit trend will persist as long as economic growth continues and Congress does not increase spending any further: A growing economy provides greater tax revenues.

Powell is scuttling that plan by keeping interest rates too high. Instead of taking responsibility for the lingering effects of his inflationary Biden-assistance plan, Powell has been blaming tariffs and workers for the current slightly elevated inflation.

The Federal Reserve consistently sees low unemployment as bad news, assuming that it will bring on price inflation as workers demand higher wages, emboldened by a reduced fear of being stuck without a job. In addition, Powell argues that tariffs will increase inflation.

Both those notions ignore the simple fact that inflation is a general rise in prices, not price increases in specific sectors of the economy. If tariffs cause the prices of imported goods and some business inputs to rise, prices of other things must fall, unless someone increases the overall money supply — and that would have to be the Fed itself.

Similarly, if wages rise, it must be because productivity is increasing, or businesses would not be able to afford to pay higher wages — unless somebody increases the overall money supply, which again points to the Fed.

If businesses decide to pay the higher wages, even if output per worker is not rising and consumers continue to buy those items at the same rate, prices of other things must fall. Less money available for purchasing or investing in those other things means lower prices — unless the central bank increases the money supply.

Stalling Trump’s progress

Try as he might, Powell cannot exonerate the Fed for the struggles with inflation.

President Trump and congressional Republicans have rolled back the worst of the pandemic- and Biden-era fiscal and regulatory mayhem in addition to the sky-high inflation under the Biden-Harris administration — and the results are beginning to show. The U.S. economy grew at an unexpectedly strong 3% annual rate in the second quarter, a clear, positive response to the tax cut extension and major deregulation over the past six months.

The recent extension of the 2017 tax cuts and the Trump administration’s rapid action to deregulate industry and energy will go far in reviving the economy, if given a chance. Unfortunately, the Fed seems determined to thwart a full recovery.

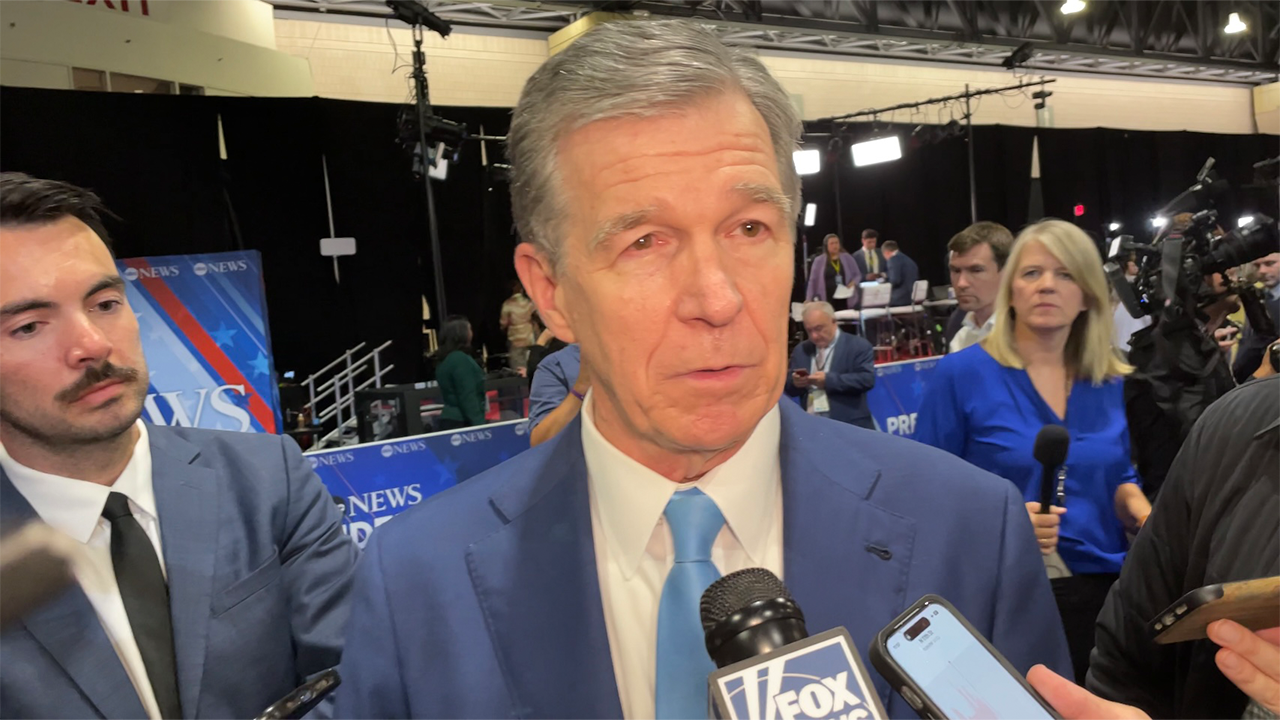

RELATED: Fed Chair Powell defies Trump, keeps interest rates unchanged despite good economic reports

Photo by Chip Somodevilla / Staff via Getty Images

“You do not see weakening in the labor market,” Powell said in his Wednesday press conference, two days before the Bureau of Labor Statistics documented that very weakness.

“Demand for workers is slowing, but so is the supply. … Wages are gradually cooling,” he continued.

We now know why wages have been cooling while the jobs market was strong: The jobs market was not strong. Powell and the Fed have been doing their best to stunt economic growth — and they are succeeding.

Stop the squeeze

All of this suggests that the Fed should reduce interest rates — gradually and with a keen eye monitoring the situation — to give the economy room to expand and take advantage of somewhat-improved federal fiscal, regulatory, and energy policies.

In addition, continuing the slow reduction of the central bank’s balance sheet, which the Fed’s governors nearly doubled in 2009 and foolishly ballooned during the second Obama administration and the pandemic, would continue to provide a brake on inflation without unduly stunting economic growth.

Though federal fiscal policy still needs serious reform — through substantial cuts in spending — squeezing the economy with tight money is certainly not the solution to our economic problems.

Read the full article here