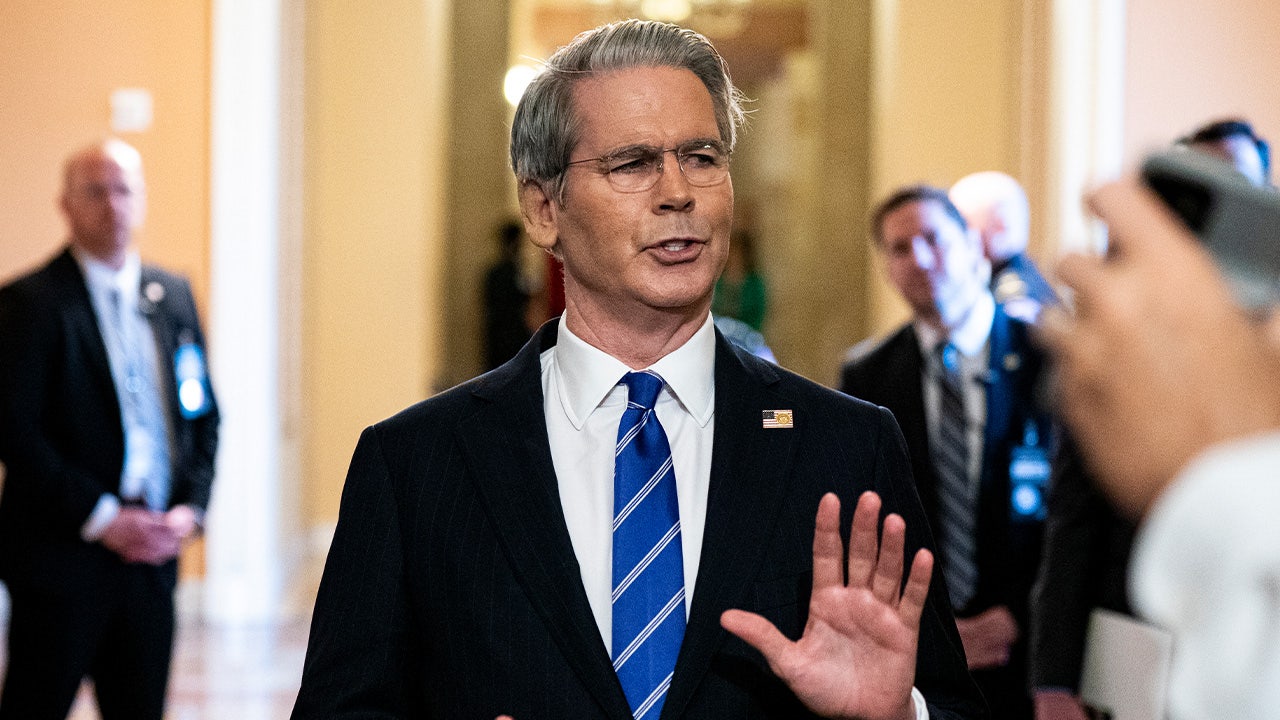

Scott Bessent said federal investigators have uncovered staggering levels of fraud involving taxpayer dollars, estimating that as much as $600 billion per year may be lost across government programs.

Bessent made the remarks while describing the work of IRS Criminal Investigations and ongoing efforts to track, investigate, and prosecute fraud tied to federal spending.

Bessent began by highlighting the role of IRS Criminal Investigations, describing the unit as a specialized enforcement arm within the agency.

“IRS called criminal investigations. And the these men and women, they, they are cool cats. They can take apart a balance sheet, and they can knock down a door and arrest someone, like they go out on patrols. They can make arrests,” Bessent said.

He described the unit as a hybrid force combining financial expertise with traditional law enforcement authority.

“It’s this very interesting hybrid force, about 2500 of them, and they led the charge here,” he said.

According to Bessent, IRS Criminal Investigations was responsible for uncovering the initial fraud and pursuing prosecutions related to misuse of taxpayer funds.

This Could Be the Most Important Video Gun Owners Watch All Year

“So it was IRS CIS who uncovered the initial fraud and the prosecutions,” Bessent said.

Bessent said investigators, working alongside other IRS divisions and Treasury Department authorities, have traced where money originated and where it ultimately went.

He said those efforts revealed troubling attempts by individuals involved in administering government programs to interfere with records after the fact.

“So it’s with that group, with other groups at IRS and with the powers of the Treasury to track where the money came from, where it’s going, we saw this very unsettling news yesterday that many people involved here with the administration of these programs have tried to go back and they recreate documents, change documents, and we’re not going to have that,” Bessent said.

He emphasized that officials responsible for such actions will be held accountable.

“We are going to hold people accountable. We’re going to press this to the full extent possible,” he said.

Bessent suggested that the fraud uncovered so far may represent only a fraction of a much larger national problem.

“And like I said, I think that this may just be, it’s cold day outside, so this could be the tip of the iceberg here in Minnesota, but it’s probably may not be as prevalent, but the dollars may be bigger and larger in other states,” he said.

He placed the scope of the issue into a broader national context by citing estimates from the Government Accountability Office.

“And just to put this in perspective, for for American taxpayers, for American families, the GAO, the General Accounting Office, believes that there is somewhere between three and 600 billion of annual fraud, roughly 10% of government spending that disappears due to fraud,” Bessent said.

Bessent said recovering even a portion of those funds would have a significant impact on the U.S. economy.

“If we can recapture that, that is one to 2% of GDP,” he said.

WATCH:

Read the full article here

![1 in 10 Tax Dollars Is Straight-Up Stolen [WATCH] 1 in 10 Tax Dollars Is Straight-Up Stolen [WATCH]](https://www.lifezette.com/wp-content/uploads/2025/12/2025.12.23-09.44-lifezette-694a6491853f2.jpg)

![Epstein Deposition Exposes Their Lies Under Oath [WATCH] Epstein Deposition Exposes Their Lies Under Oath [WATCH]](https://www.lifezette.com/wp-content/uploads/2025/07/2025.07.24-11.23-lifezette-688217a7e9dab.jpg)

![Stephen Miller Says Crush Them Like We Crushed ISIS and Al-Qaeda [WATCH] Stephen Miller Says Crush Them Like We Crushed ISIS and Al-Qaeda [WATCH]](https://www.lifezette.com/wp-content/uploads/2025/08/2025.08.17-04.04-lifezette-68a1fd8380008.jpg)